34+ can mortgage interest be deducted

So lets say that you paid 10000 in mortgage interest. Register and Subscribe Now to Work on Pub 936 More Fillable Forms.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

. Web Typically home mortgage passion is any kind of rate of interest you pay on a loan protected by your house main residence or a second residence. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web You cant deduct the principal the borrowed money youre paying back.

Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. Web Essentially you cant deduct interest on your third fourth or fifth homeor any property you rent out. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Complete Edit or Print Tax Forms Instantly. 11 2023 the IRS announced that California storm victims now have until May 15 2023 to file various federal individual and business tax returns and make. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

And lets say you also paid. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. However higher limitations 1 million 500000 if married.

Web On Jan. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Web For 2021 tax returns the government has raised the standard deduction to.

Married filing jointly or qualifying widow er. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. In addition to itemizing these conditions must be met for mortgage interest to be deductible.

Ad Access Tax Forms. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Most homeowners can deduct all of their mortgage interest.

Single or married filing separately 12550. If you are single or married and. 750000 if the loan was finalized after Dec.

Web You also cant deduct the interest on any portion of your mortgage debt that exceeds 750000 375000 for single taxpayers or married taxpayers who file. Web Mortgage Interest - For total mortgage interest paid during the tax year the percentage of mortgage interest that is equal to the percentage of the year the. In order to claim this deduction you must use the property for.

Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year.

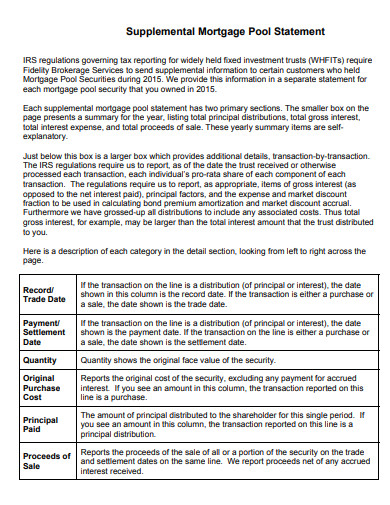

Mortgage Statement 10 Examples Format Pdf Examples

Mortgage Interest Deduction Bankrate

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Mortgage Interest Deduction Bankrate

Calameo The Good News May 2010 Broward Issue

Mortgage Interest Deduction Bankrate

34 Payment Schedule Templates Word Excel Pdf

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Mortgage Statement 10 Examples Format Pdf Examples

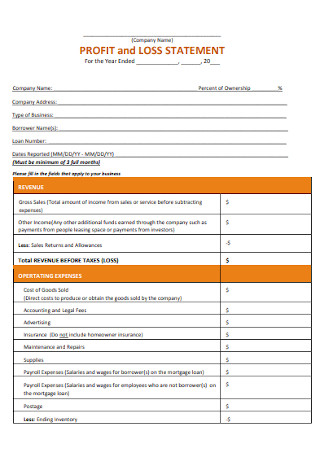

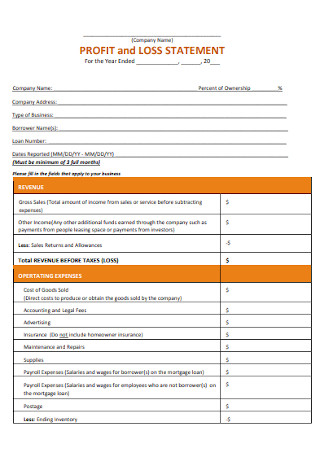

34 Sample Profit And Loss Statement Templates Forms In Pdf Ms Word

Maximum Mortgage Tax Deduction Benefit Depends On Income

How Much Mortgage Interest Is Tax Deductible Section 24 Tenant Tax

Mortgage Interest Deduction A Guide Rocket Mortgage

A Helpful Tax Write Offs List For 1099 Contract Dance Teachers Special Thanks To Financialgroove Com For Pr Dance Teacher Teacher Supplies List Dance Teachers

Mortgage Interest Deduction Rules Limits For 2023

List Of Top Financial Services Companies In Kangra Best Finance Companies Justdial

Solved 10 Use A Half Angle Formula Or Summation Identity To Calculate The Course Hero